UPDATED SEPTEMBER 1, 2021 This piece has been updated to reflect the emergence of new technology

Christian Mathews Security Writer

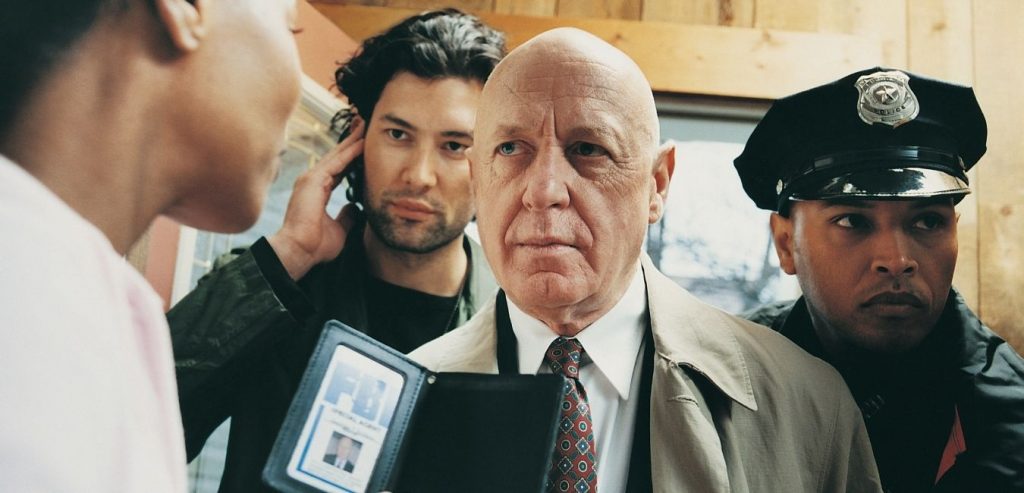

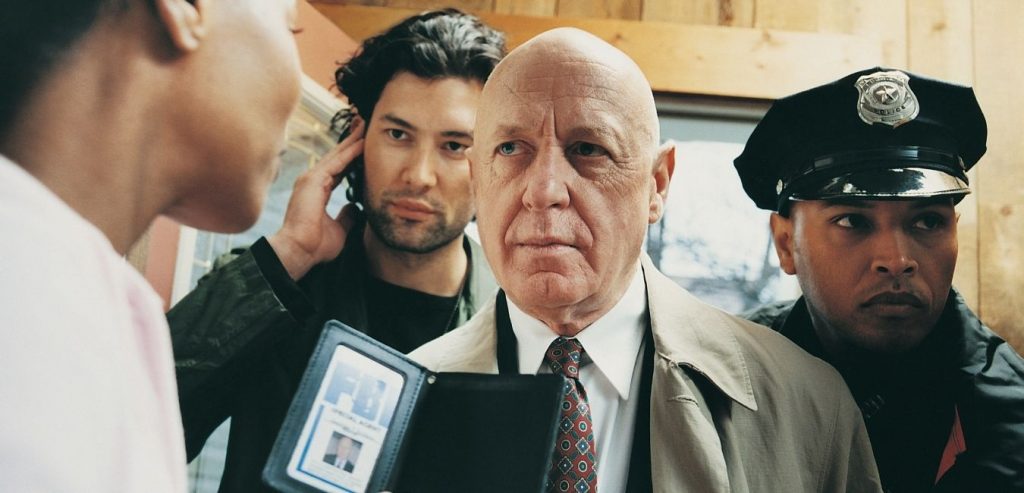

Imagine the police knocking on your door to inform you that you’ve been implicated in a crime, or are regarded as a suspect in an ongoing investigation. Or being called and asked to pay a debt, you can for the life of you not recall making. You just might be a victim of identity theft.

These are extreme cases, but if data from the Federal Trade Commission (FTC) is anything to go by, cases of stolen identities are on the rise, and the implications could be dire for any one unlucky enough to be a victim.

According to the Federal Trade Commission, there are on average about 9 million cases of identity theft per year in the United States alone.

This so-called: “silent crime”is real and it’s growing. Through this article, we will look at:

- The signs of Identity theft

- How to correctly verify if your identity has been stolen.

- What can be done if you are a victim of identity theft.What you can do to avoid being a victim of identity theft.

1How to Find Out if Someone Stole Your Identity

People generally don’t become aware that their identity was stolen until several months or even years later. This is mostly due to the false sense of security most people have when it comes to this crime. No one thinks this will happen to them.

If you suspect that your identity has been stolen, here are a few ways to determine whether you’re a victim:

Irregular Bank Statements

Don’t recognize some entries on your bank statement? Notice some suspicious purchases you don’t remember making? Cash withdrawals, gift card purchases, or purchases made on e-commerce sites, these are all examples of how identity theft could be initiated.

One way to identify identity theft is by asking a bank employee to go through the list of transactions with you, and flag any that look suspicious. If anything comes up you will have to get your bank’s fraud division involved as soon as possible. Any discrepancy, no matter how minor might confirm identity theft.

Tax Return Errors

When you get an error notification when filing your tax returns this might indicate identity theft. You will have to contact the Tax Authorities as soon as possible to confirm the various sources of income registered in your name. You might find that you are listed as having several sources of income that you were unaware of.

The criminal aim in doing this is to fraudulently collect your Tax refund.

Data Breaches

When you are informed of a data breach that may have inadvertently leaked your personal information. This could be from your employer, insurer, or even financial institution.

In this case the likelihood of identity theft is very high. For instance, if the breach was at your bank, it’ll be a case of financial identity theft that’ll lead to you losing money. If it’s from your insurer, you might have claims filed on your insurance. In this case, it may be medical identity theft.

Late or Missing Mail

Late or Missing mail might indicate Identity theft as the person stealing your identity is going through your mailbox to get your personal information. With your information this person could easily then be making purchases, and other debt on your behalf. To combat this, consider renting a closed box at the post office combined with an alert for whenever you are to receive new mail.

Denial of Credit

If you have been consistent with your credit card payments, and all of a sudden you are denied credit, this might be a huge red light that something is wrong. To confirm this, you’ll have to request your credit report as well as a list of payments from your card. Whoever stole your identity has, most likely, maxed out your cards, gotten other credit cards in your name, and even possibly ruined your credit score.

2So what can you do if You’re Certain Your Identity has been Stolen?

It’s quite unnerving, hard to deal with, but should you find yourself in this position, here’s what to do if your identity was stolen:

- The first step would be to inform the authorities, and especially those that deal with fraud cases. Depending on where you live, there may be specialized agencies; for instance, in the US the FTC

- Submit a report with local law enforcement due to the following reasons:.

- This allows you the chance to exonerate yourself. This is especially true if you have been falsely implicated in a crime as a result of your identity being stolen.

- This information might help the police in apprehending criminals.

- Call your bank/ financial institution informing them that your identity has been stolen.

Ask them to freeze your account or, even better, place a fraud alert on your account. This will prevent criminals from causing more damage, and help with your credit report should a lender try to access it.

- If you’re a victim of medical identity theft, inform your insurer of the matter as soon as possible. Doing this will prevent claims from being filed under your name.

3How to Prevent Identity Theft.

Knowing if someone stole your identity is a large part of the solution. Knowing how to protect yourself from identity theft is another. Although identity theft is not completely preventable, there are some measures that will make it much harder for would-be fraudsters.

- Always shred any document that may have your personally identifiable information on it before dumping it in the trash. Why? Dumpster diving is common among most attackers. This is where they rummage through your trash in the hopes of finding anything that may have your personal information on it. This could be anything from receipts, credit cards statements, or even bank transaction slips. If you do need to hold on to the statements for a while, make sure it is stored securely in a reliable document safe.

- Never log in to your bank account while on public Wi-Fi. This also applies to online shopping. Only use private Wi-Fi or a secure mobile internet connection.

- Ensure you have a proper up-to-date antivirus program installed on your personal computer. This will help flag any malicious files you may be downloading or sites you might be visiting.

- At all times, have a strong password on your computer. To be clear, never use names, birthdays, or any other personal information that can be easily found in the public domain. (And this includes public/government databases). Make sure to regularly update a password protected External hard drive with all your important documents and personal passwords.

- Refrain from sharing your personal information on the internet (Yes, even on social media)

- Make sure when traveling to have all your important documents, and means of identification organized and secured. A document travel organizer might make it easier to keep track of all your personal information.

4Conclusion

That about sums it up for how to know if someone stole your identity. It all boils down to: Be smart, stay safe, stay vigilant.